All Categories

Featured

Table of Contents

- – Reliable Accredited Investor Alternative Asset...

- – High-Quality Real Estate Investments For Accre...

- – High-Performance Accredited Investor Alternat...

- – Market-Leading Accredited Investor Investment...

- – Exclusive Accredited Investor Financial Grow...

- – Best-In-Class Accredited Investor Alternativ...

- – Advanced Accredited Investor Funding Opportu...

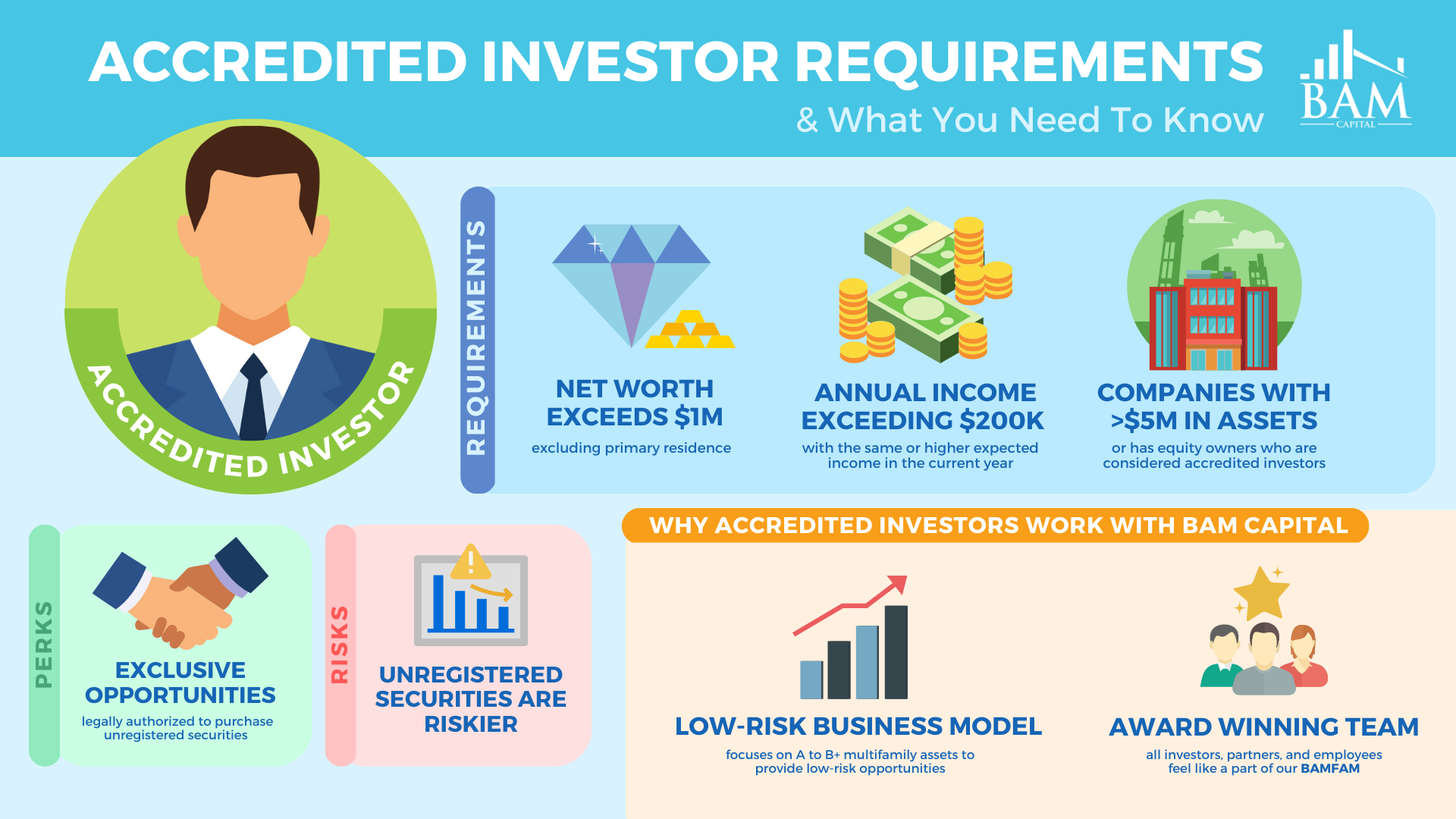

The guidelines for certified capitalists differ amongst jurisdictions. In the U.S, the meaning of a certified investor is presented by the SEC in Regulation 501 of Policy D. To be a certified investor, an individual must have a yearly earnings exceeding $200,000 ($300,000 for joint income) for the last two years with the expectation of gaining the exact same or a higher revenue in the present year.

This quantity can not include a main residence., executive police officers, or supervisors of a firm that is providing unregistered securities.

Reliable Accredited Investor Alternative Asset Investments for Consistent Returns

If an entity consists of equity owners who are approved financiers, the entity itself is a recognized investor. An organization can not be created with the single objective of acquiring details safeties. An individual can certify as a recognized capitalist by demonstrating enough education or work experience in the monetary market

Individuals who intend to be approved capitalists don't relate to the SEC for the designation. Instead, it is the responsibility of the firm supplying an exclusive positioning to make sure that every one of those approached are accredited financiers. People or celebrations that intend to be certified capitalists can come close to the provider of the non listed safety and securities.

As an example, intend there is a private whose income was $150,000 for the last three years. They reported a main residence worth of $1 million (with a mortgage of $200,000), a car worth $100,000 (with an outstanding car loan of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This person's net well worth is exactly $1 million. Since they satisfy the net well worth need, they certify to be a recognized financier.

High-Quality Real Estate Investments For Accredited Investors for Accredited Investors

There are a few less typical certifications, such as handling a trust fund with greater than $5 million in properties. Under government protections regulations, only those that are approved investors may take part in particular safety and securities offerings. These might consist of shares in personal positionings, structured products, and private equity or bush funds, to name a few.

The regulators intend to be specific that participants in these very risky and intricate financial investments can take care of themselves and evaluate the risks in the lack of government security. The certified capitalist regulations are created to shield potential capitalists with minimal monetary expertise from adventures and losses they might be ill furnished to hold up against.

Recognized investors fulfill credentials and professional requirements to access special investment opportunities. Certified financiers need to meet earnings and internet worth requirements, unlike non-accredited people, and can invest without restrictions.

High-Performance Accredited Investor Alternative Investment Deals with Maximum Gains

Some essential adjustments made in 2020 by the SEC include:. Including the Series 7 Collection 65, and Series 82 licenses or other credentials that show financial proficiency. This modification identifies that these entity types are typically used for making investments. This adjustment acknowledges the know-how that these employees develop.

These changes increase the recognized capitalist swimming pool by approximately 64 million Americans. This wider gain access to supplies a lot more possibilities for capitalists, however likewise boosts prospective risks as much less economically innovative, investors can get involved.

One significant benefit is the chance to purchase positionings and hedge funds. These financial investment options are unique to accredited capitalists and establishments that qualify as a certified, per SEC policies. Private positionings allow business to protect funds without browsing the IPO procedure and governing documentation required for offerings. This offers accredited financiers the opportunity to buy arising firms at a phase before they consider going public.

Market-Leading Accredited Investor Investment Opportunities

They are considered as financial investments and are accessible just, to certified clients. Along with recognized companies, certified investors can choose to purchase startups and promising ventures. This uses them tax returns and the chance to enter at an earlier phase and potentially gain incentives if the firm prospers.

Nevertheless, for investors open to the dangers involved, backing start-ups can cause gains. Most of today's tech companies such as Facebook, Uber and Airbnb stemmed as early-stage start-ups supported by certified angel capitalists. Innovative investors have the possibility to explore financial investment alternatives that might generate much more profits than what public markets use

Exclusive Accredited Investor Financial Growth Opportunities for Accredited Investors

Returns are not guaranteed, diversity and portfolio enhancement alternatives are broadened for financiers. By expanding their portfolios through these broadened investment opportunities accredited capitalists can boost their approaches and possibly attain premium long-term returns with correct risk monitoring. Experienced financiers often experience investment options that might not be conveniently readily available to the basic investor.

Financial investment alternatives and safety and securities used to certified capitalists usually include higher dangers. For instance, exclusive equity, equity capital and hedge funds typically focus on spending in properties that bring threat however can be liquidated conveniently for the opportunity of greater returns on those risky investments. Looking into before spending is critical these in situations.

Lock up periods stop capitalists from withdrawing funds for even more months and years on end. Investors may have a hard time to precisely value personal assets.

Best-In-Class Accredited Investor Alternative Investment Deals with High-Yield Investments

This change might prolong accredited capitalist status to a range of people. Allowing companions in committed partnerships to integrate their resources for shared eligibility as accredited capitalists.

Making it possible for people with specific expert qualifications, such as Collection 7 or CFA, to certify as recognized investors. Producing extra demands such as evidence of monetary proficiency or successfully finishing an accredited investor examination.

On the other hand, it might likewise cause experienced investors presuming extreme risks that may not appropriate for them. So, safeguards might be needed. Existing recognized capitalists might face increased competitors for the best investment possibilities if the pool expands. Business increasing funds may take advantage of an expanded recognized financier base to draw from.

Advanced Accredited Investor Funding Opportunities with Growth-Focused Strategies

Those that are presently taken into consideration accredited capitalists have to remain upgraded on any kind of changes to the requirements and guidelines. Their qualification may be based on adjustments in the future. To keep their condition as certified financiers under a changed meaning changes may be necessary in wide range monitoring methods. Businesses seeking accredited financiers should stay alert about these updates to ensure they are bring in the appropriate target market of financiers.

Table of Contents

- – Reliable Accredited Investor Alternative Asset...

- – High-Quality Real Estate Investments For Accre...

- – High-Performance Accredited Investor Alternat...

- – Market-Leading Accredited Investor Investment...

- – Exclusive Accredited Investor Financial Grow...

- – Best-In-Class Accredited Investor Alternativ...

- – Advanced Accredited Investor Funding Opportu...

Latest Posts

Back Tax Homes For Sale

Free List Of Tax Lien Properties

Find Tax Lien Properties Free

More

Latest Posts

Back Tax Homes For Sale

Free List Of Tax Lien Properties

Find Tax Lien Properties Free